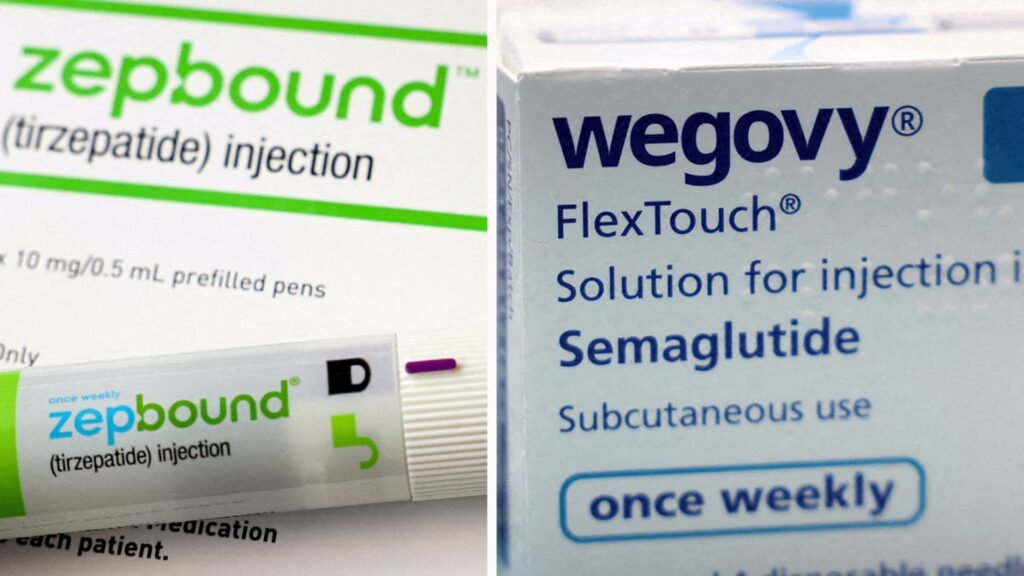

In this article, Eli Lilly announced on Wednesday that its obesity drug Zepbound resulted in more weight loss compared to its main competitor, Novo Nordisk’s Wegovy, in the first direct clinical trial involving weekly injections. The study findings indicate that Zepbound could be a more effective treatment for weight loss, with obese or overweight individuals losing an average of 20.2% of their body weight, approximately 50 pounds, after 72 weeks in the phase three trial. In contrast, Wegovy helped participants lose 13.7% of their weight, around 33 pounds, over the same period.

Eli Lilly reported that Zepbound achieved a 47% higher relative weight reduction than Wegovy in the trial. Moreover, over 31% of Zepbound users lost at least a quarter of their body weight, while only about 16% of Wegovy users achieved a similar level of weight loss.

Additional studies and a recent analysis of health records have also suggested that Zepbound may outperform Wegovy in terms of weight loss. A late-stage study on Zepbound demonstrated an average weight loss of over 22% after 72 weeks, while a separate study on Wegovy showed an average weight loss of 15% over 68 weeks.

The latest data from Wednesday’s trial, which randomly assigned 751 patients to receive the maximum dose of either drug, provides strong evidence of Zepbound’s superiority. The study focused on patients who were obese or overweight with at least one weight-related medical condition, excluding diabetes.

Dr. Leonard Glass, senior vice president of global medical affairs at Eli Lilly Cardiometabolic Health, stated that the study aimed to assist healthcare providers and patients in making informed decisions regarding treatment options. Eli Lilly is currently reviewing the results for publication in a peer-reviewed journal and presentation at a medical conference next year.

The most common side effects of both drugs were gastrointestinal and generally mild to moderate in severity. Eli Lilly’s Zepbound’s greater weight loss potential presents a significant advantage in the competitive weight loss drug market, where the company is vying with Novo Nordisk for a larger market share projected to reach $150 billion annually by the early 2030s.

Although Wegovy entered the market approximately two years before Zepbound, which received approval in the U.S. in late 2023, analysts believe Zepbound has the potential to become the best-selling drug of all time with more years on the market. GlobalData forecasts Zepbound to generate $27.2 billion in annual sales by 2030, while Wegovy is expected to generate $18.7 billion in annual revenue by the same year.

The high demand for Zepbound, Wegovy, and their diabetes counterparts has led Eli Lilly and Novo Nordisk to invest billions in expanding their manufacturing capacity for the injections. This effort has been successful, as the Food and Drug Administration now lists all doses of these treatments as “available” on its drug shortage database.

However, some patients face challenges in accessing these drugs due to inconsistent insurance coverage for weight loss treatments in the U.S. Without insurance or other financial assistance, both Zepbound and Wegovy cost around $1,000 per month.

These treatments operate differently: Zepbound suppresses appetite and regulates blood sugar by activating two gut hormones, GIP and GLP-1, while Wegovy activates GLP-1 without targeting GIP, potentially affecting how the body processes sugar and fat.